How to Pay Tuition Fees on Your Own in Canada?

How to pay your college fees in Canada with your own earnings?

These were some of the questions I was asked when I started creating YouTube Videos on University of Toronto‘s application and scholarships. Moreover, some of my school friends have been studying and fully paying their college tuition fees and living expenses (at the same time) as international students in Canada; hence, I decided to take this opportunity to explain you how YOU can pay YOUR college expenses on YOUR own while studying as an international student in Canada not only your tuition fee but living expenses and all the other expenses too.

This post will be immensely helpful to you if you are planning to study in Canada but don’t know about the various opportunities to finance your education on your own. So, do stick around till the end of it.

But before we start, if you’d like to watch me speak and explain everything to you instead of reading this post, you can watch my video on the same topic down below 👇

Costs when Studying in Canada

Before we talk about how to pay our college expenses, we need to know exactly what expenses an international student needs to pay when studying in Canada. These expenses include your tuition, on campus or off campus housing, transportation, groceries, meals, health insurance, mobile phone, entertainment and other miscellaneous expenses.

Scholarships

Out of all of these expenses, the highest and the most heaviest is the college or university’s tuition. So first, let’s talk about a way to reduce this expense or clear it off completely even before you reach Canada.

Admission-based Scholarships (Entrance Scholarships)

This is can be achieved through Scholarships. Almost all universities in Canada offer some form of scholarships to international students, a majority of universities including University of Waterloo, University of Alberta, University of Ottawa, University of Calgary etc. offer automatic entrance scholarships to international students. These automatic entrance scholarships do not require an additional applications and are based purely on your academic performance. So if you score a certain percentage in your final exams, the university offers you a scholarship which waives some thousand dollars off your tuition fee for your first year of study.

Generally, these scholarships are renewable for your second, third and fourth year, if you keep maintaining a high score in your academics. Also, the amount you’ll receive as a recipient of the scholarship and the specific percentage required to get the scholarship depends on the university you’re applying to. For instance, University of Waterloo offers a 10,000 CAD scholarship, called the International Student Entrance Scholarship, if you maintain an average score of 90% or above.

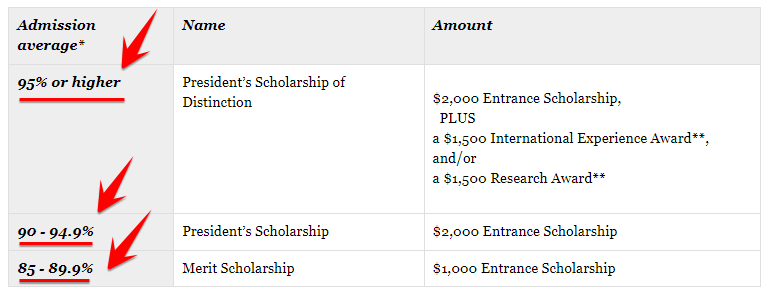

Moreover, most universities have charts like the one I showed down below 👇, where the higher you score, the more amount they offer in the automatic entrance scholarship.

You can find these scholarships by adding adding “automatic entrance scholarship” when googling the university name. For instance, you want to search for automatic entrance scholarships at the University of Alberta, search for the sentence “University of Alberta automatic entrance scholarships” and click on the university’s official website’s first link. You will be redirected to a page which shows three automatic entrance scholarships (no application required to be submitted) for international students at the university 👇.

These automatic entrance scholarships are guaranteed, so it’s up to you to work hard and get the score to save you some thousands of dollars. I think there is no better way to reduce your tuition than scoring high and getting an automatic entrance scholarship. Otherwise, if you don’t receive one, you’ll have to use your time in Canada to work and pay the money which you could’ve easily waived by maintaining a high academic standing.

Application-based Scholarships

On the other hand, there are some universities like University of Toronto, University of British Columbia, York University and Concordia University which not only offer automatic entrance scholarships but also offer some very generous scholarships to international students which can cover your tuition fee anywhere from 60% to 100%. Some of these scholarships includes

- UBC International Scholars Program

- UBC Outstanding International Student Awards

- York University International Entrance Scholarship of Distinction

- Concordia Presidential Scholarship

- Concordia International Scholars

If we take the example of University of Toronto where I got admitted, it has a fully funded scholarship program for international students called the Lester B. Pearson Scholarship which covers your tuition fee, living expenses and all the other expenses for all four years of your study. I have created a dedicated post on the Lester B. Pearson scholarship, where I have not only covered, in great detail, the application process, eligibility criteria, essay questions, evaluation criteria but have also shared my personal tips to win the scholarship. If you are interested, do check it down below.

Check Here 👉 How To Get Full Scholarship at University of Toronto as an International Student

Apart from this full ride or 100% scholarship, U of T also has a very generous merit scholarship called the University of Toronto International Scholar Award which waives more than 75% of your tuition fee at U of T every year for four years (assuming you maintain your academic performance and the tuition stays the same i.e., ~60,000 CAD / year).

I received the U of T International Scholar Award for the fall of 2021 and have created a detailed post on how students can greatly maximize their chances of receiving this award with few guided steps. Again, if you are interested in knowing more about this scholarship, you can check the post by clicking the link down below.

Check Here 👉 How I Got $225,000 Scholarship from University of Toronto & How You Can Too

Now, if you score high and receive an application-based scholarship i.e., a major scholarship which is covering all of your tuition or a major chunk of your tuition, it’ll be easy for you to pay off other expenses because you’ll have the freedom to basically spend or save all the money you’ll be earning from the other methods I am about to share.

But if you don’t receive a major scholarship because a only a minority of students receive these application-based scholarships, you can at least get an admission-based scholarship or automatic entrance scholarship which can help you by waiving a few thousand dollar from your tuition, and these few thousand dollars can’t be underestimated because they are saving you a ton of time which you’d have to otherwise spend working in Canada to ensure you pay that money to the University.

Therefore, try your best to build a good profile and maintain a high average score in your high school, ideally above 90%, so you increase your chances of getting a application-based scholarship or an admission-based scholarship.

Bursaries

Alongside automatic entrance scholarship, you can also look for Bursaries offered by the university. Bursary is a grant given to a student based on financial need. The amount given as bursary depends on the university but usually it ranges from CA$500 to CA$6000.

Most Canadian universities offer very few bursaries to international students, but if you research and proactively check with the university, you can easily save anywhere between CA$500 to CA$6000 if you genuinely need the money. For instance, University of Waterloo and University of Alberta offer emergency bursaries of a few thousand dollars to international students if they are in financial need.

Part Time Jobs

Ok, now, let’s talk about the first way you can actively convert your extra time into money, to pay your college expenses in Canada. It is by working Part-time after your classes.

When you receive your student study permit, you will be able to work on campus and off campus even without a work permit and by working part-time after your classes, you will you will be able to earn money which you can use however you want (ideally to pay your college expenses).

Now you might be wondering whether you can pay all of your expenses with just your part-time job. Unfortunately, you can’t, because as an international student in Canada, you have limitation on the number of hours you can work part-time. You can only work 20 hours per week while your studies are going on and working more than 20 hours/ week is ILLEGAL as it is a violation of the study permit conditions.

So for the 20 hours you work, you get paid the minimum wage which ranges from CA$11 to CA$ 15 depending on the province you’re studying in. In Ontario, where most international students study, the minimum wage is 14 Canadian Dollars and even if you work 20 hours/ week for all the semesters, it is very difficult to pay your tuition fee completely regardless of whether you are doing a degree or a diploma.

One more thing I want to share here is that most people think working on cash is illegal in Canada, but that’s not true. You can work on cash as long as you and your employers are recording the transactions for tax and other purposes. Actually, It is illegal for an international student to work on cash and not report the number of hours worked and the money earned to the Canadian government, so I would recommend you to not choose that route and not exceed the 20 hours/ week limit.

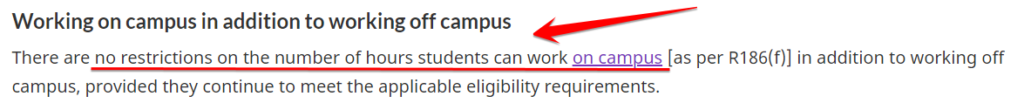

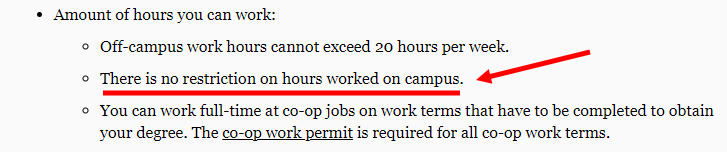

But do you want to know a way to legally work more than 20 hours/ week while studying? Ok let me share, there is no limitation or restriction on the number of hours you work per week if you work on campus. The 20 hours/ week limit only applies if you are doing any part-time job off-campus. So if you take a part-time job on your college or university’s campus, you’ll have no limitation on the working hours.

Ok, let me confirm this to you by showing the following statement on the official website of the Government of Canada 👇: “there are no restrictions on the number of hours students can work on campus in addition to working off campus.”

What do I mean by on-campus and off-campus?

Working off-campus: you can work at any location outside the boundaries of the campus of the educational institution at which you’re studying.

Working on-campus: you can work at any business or building or facility inside the boundaries of the campus.

I would definitely recommend you to work on campus not only because you have the flexibility to work as many hours you want and make more money but also because on campus part-time jobs such as working as a research assistant or teaching assistant in your field of study can immensely help you in building your resume and provide you with Canadian work experience which will help you in getting a good full time job in the future as most employers look for employees with work experience in the field.

So you are killing two birds with one stone because you are both earning money and getting Canadian work experience in your field at the same time.

But again, I would caution you that even though the Canadian law allows you to work as many hours as you want on campus, the university might not allow you to work a lot, generally not more than 30 hours per week, because if you’re working so much and studying at the same time, one of the two things might suffer and the university might not want you to get overwhelmed and exhausted.

So, before you go to the university, I would suggest you to confirm with the university about the number of on-campus working hours per week as they might have specific conditions for it. I know for sure that University of Waterloo doesn’t restrict students from working as many hours as they want on campus and if you know any other university which doesn’t limit the working hours, do comment it down below so we help each other out.

Now, if you are thinking how long will it take to get a part-time job? Will I get a part-time job easily because of Covid restrictions? Don’t worry. There are plenty of off-campus jobs available in Canada. It usually takes one to two months to find a job but it might take even longer if you don’t have a good network of friends. With regards to on-campus jobs, it depends on the university you have applied to, but if you are proactive in contacting the university for it, you might get it in no time.

In April 2021, one of my close friends went to Sheridan College in Brampton, Ontario and he was so worried about getting a part-time job. But when he landed in Canada and took a month to search for job opportunities, he got a part-time job in one month’s time. And now he is working. So yea, it’s not hard to find part-time opportunities, you just need to keep trying until you get one.

Full Time Jobs

Now, let’s talk another way you can make even more money than working part-time. It is through Full Time Jobs.

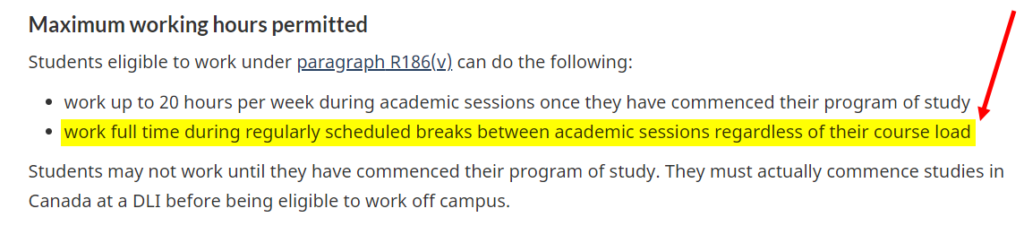

During your study in Canada, you have the opportunity to work full-time in your university’s regular breaks which means that you can work every single day for the entire summer and winter vacations. The summer and winter holidays are almost equal to 4 months.

Moreover, you can also work full time in your university’s scheduled breaks such as reading weeks in fall and spring. This will give you plenty of time to work as many as 40 hours per week and earn money to support your studies and stay, but it will require a lot of commitment and work from your side.

Unlike working Part-time, there is no restriction on the number of hours you can work full time whether it is on-campus or off-campus. You are even allowed to work over time or in night shifts to make more money.

Also, if you are unable to find a full time job or you are searching for it, you are free to work two part-time jobs to increase your working hours. But remember one thing, you can’t work full time before your first semester at the university.

Here, I would like to share the story of one of my seniors in school who also studied at Sheridan College in Canada. By working full time during all of the university’s breaks, he was able to completely pay his tuition because he managed to find good, high paying jobs which were well above the minimum wage of CA$14.

Co-op Programs (kinda like Internships)

Now, let’s talk about a really great way to build your profile and earn money to support your finances at the same time. You can earn significantly more money with this method than with any other method I have shared. This is through Co-op programs.

What is Co-op?

Co-op programs are quite different than most programs because in Co-op programs working and studying is embedded inside the curriculum. So co-op students work in an industry job related to their field of study while also studying the theoretical program courses at the University.

The purpose of Co-op programs is to develop your real-world skills in the field you’re pursuing by giving you exposure to different jobs and careers inside your area of study.

Most co-op programs in Canada are structured in an alternating pattern of studying and working, which means that 1 semester or 4 months studying is followed by 4 months of working full time at a company partnered with the university. So you will have 1 semester of studies, then 1 semester of work, then 1 semester of studies and then 1 semester of work.

Now, the work you do as part of your Co-op is like an internship but not the same as internship, because an internship is a work between an employer and a student which can be paid or unpaid whereas Co-op is a work between a university, employer and a student. It is always paid and involves a specific program structure.

Benefits of Co-op

The benefits of doing Co-op programs are huge esp. in Canada.

✅ Gain Practical knowledge and skills in your industry and field of interest.

✅ Explore different jobs in your field that will help you decide which one is right for you.

✅ Canadian work experience helps in securing a good full time job esp. a high paying one.

✅ Get paid for the work you do.

Most people don’t know this, but Cop-op work is paid way above the minimum wage. Though the exact amount depends on your field, university and your university’s tie up with the companies, the pay rate ranges from CA$14/ hour to CA$25/ hour.

Almost every Canadian university which offers a co-op program has a dedicated team to help students and connect them with suitable co-op work, so don’t think it’s hard to get co-op work because with the assistance of the university, you’ll definitely get one.

Here is the list of all the Top Canadian universities with the best co-op programs.

☑ University of Waterloo

☑ University of Alberta

☑ Queens University

☑ University of British Columbia

☑ University of Saskatchewan

☑ University of Toronto

☑ Ryerson University

☑ Centennial College

☑ Georgian College

☑ Fanshawe College

☑ George Brown College

☑ Conestoga College

☑ Humber College

If you’ve watched my previous videos, you’d definitely know that I got accepted at University of Toronto Scarborough’s Computer Science Co-op with 75% scholarship in the form of U of T International Scholar Award. If you’d like to know how I got accepted, I would definitely recommend you to check out my “How I Got Into University of Toronto” post down below 👇.

Check Here 👉 How I Got Into University Of Toronto (Stats, Extracurriculars, Advice, Supplementary App., OUAC)

Non-Traditional Earning Methods

Now, before moving forward, I would like to tell you guys that these are all the traditional methods of earning and they are very specific to Canada. In this video, I haven’t covered the non-traditional methods of earning that can help you pay your expenses regardless of whether you are studying at college in Canada or a college in India because it would’ve taken me an hour to cover all the non-traditional methods of earning.

That’s why in one of my next YouTube videos, I will be covering all the different ways of making money in college no matter whether you are studying at University of Toronto or University of Tokyo or University of Delhi. This includes stuff from freelancing to personal branding. So do Subscribe my YouTube Channel to not miss that video. That video will truly open your mind to a lot of possibilities.

Reducing Monthly Expenses

Now, I would like to talk about another very important aspect in paying your college expenses on your own in Canada which is the importance of controlling your monthly expenses and reducing them as much as you can. Let me explain this to you.

So before you enter Canada you need prove to the Canadian embassy that you’ll be able to afford the living expenses by showing your Guaranteed Investment Certificate (GIC). In GIC, you need to add money so you can pay the living expenses for your first two semester in Canada. So when you come to Canada, every month you can withdraw a certain amount of money from your GIC to pay for your living expenses. Ideally, you should keep your monthly expenses below the amount you’ll receive from GIC every month: Monthly Expenses < Monthly GIC

It is extremely important for you to plan your expenses, avoid unnecessary expenses, choose cheap and affordable housing, lower your cost in groceries and other fun activities, so you can pay off your living expenses just from the GIC money and save all the money from other methods for your 2nd, 3rd 4th year’s tuition and living expenses.

Moreover, you need to realize that there will always be uncertain and miscellaneous expenses like medicinal costs or laptop repair etc. which might pop up anytime during your study. Even if these random expenses occur, make sure you cover them up in the next months by earning more or consuming less. That’s why it’s so important not only have a plan but to also have a backup plan for your finances and actively work towards reducing your costs to be able to achieve your goals.

Importance of Hard Work

If you are able to utilize these methods and work dedicatedly, I guarantee you’ll be able to pay your tuition fee, living expenses, meal costs, transportation and other expenses like thousands of international students from India and other countries.

If you don’t receive an application-based scholarship (major scholarship), you’ll just need your family’s money to pay your 1st and 2nd Semester fee, add money in GIC and travel to Canada. Once you are in Canada, you’ll have all the options (I mentioned above) to make enough money to afford the rest of your study and stay on your own.

It depends on you and your mindset to make this possible. Working part-time, studying and living in a different country at the same time can be quite challenging and overwhelming but if you are determined, hard working and disciplined, you’ll be able to do it.

Summary

Lastly, to summarize this video, I would say you need to maintain high academic standing throughout your high school to apply for co-op programs and be considered for both admission-based scholarships and application-based scholarships.

Once you reach Canada, you need to work part time during your studies and full time during your breaks. With co-op program, your overall year would roughly look like this:

🟠 4 months of studies and part-time.

🟡 4 months of paid co-op work and part-time.

🟢 4 months of full time in your vacations.

And in between all of this, you will try to actively reduce your monthly living expenses and save money as much as you can. Now, with this in mind, tell me how you’ll not be able to cover all of your college expenses on your own.

If you need further proof, let me tell you that I personally know people and have seen videos of lot of international students who are able to pay their college fees and living expenses on their own. Down below, I will list down all the videos of these inspiring students who share the exact breakdown of their college expenses in Canada and how they managed to pay them. If you are interested and want to get a better idea, I highly recommend you watch these videos 👇.

📌 Can You Pay Your Tuition Fee As An International Student In Canada?

📌 How I Pay My Tuition Fees In Canada On My Own? | International Student In Canada | $16,000+

📌 How I Paid My Fees Myself While Studying In Canada| Fully Explained

📌 How To Pay Your College Fee As An International Student In Canada?

Topics Covered

Now, doing a recap, I’ve talked about the different expenses an international students needs to pay while living and studying in Canada.

Secondly, I talked about scholarships and bursaries which can help you fully or partially pay your tuition fee even before you reach Canada.

Thirdly, I talked about the opportunity of working part time in Canada, from working limited hours off campus to working unlimited hours on campus.

Then, I talked about utilizing your university or college’s schedules breaks in which you are allowed to work full time by the Canadian government.

After that, I talked about the importance and various benefits of taking a co-op program which teaches you both theoretical and practical knowledge of your field and the practical work also pays you.

Lastly, I talked about believing in yourself, saving more and actively trying to reduce expenses by avoiding unnecessary purchases.

With that being said, I would like to thank you so so much for sticking around till the very end.

Comment “I CAN DO IT” in the comment section below to let me know that you’ve read the full post.

Please share this post with other students who want to fulfill their dreams but lack of information pose obstacles in their path.

Again, Thank you so much for reading this.

Good Bye and Take Care.

The most affordable College in Canada for international students this year is by far The Toulon Vocational College.